BASIS ID Review

What is BASIS ID?

BASIS ID is an identity verification and management platform built to accelerate the onboarding process of their customers by automating and streamlining KYC/AML (Know Your Customers/Anti Money Laundering) procedures, enabling users to quickly know the risk level of their customers and potential clients. Aimed towards companies that offer financial products and services, BASIS ID can perform KYC/AML checks on customers from over 90 countries and is ready to go in five minutes or less.

With BASIS ID, users can increase their conversion rate. The software delivers powerful and optimized KYC experiences for users based on prevailing legislation and best practices. On top of that, BASIS ID’s infrastructure is compliant with international AML standards such as FINMA, MAS, HKMA, GDPR, SEC, FCA, and FinCEN regulations and guidelines.

Show MoreOverview of BASIS ID Benefits

Due Diligence Guaranteed

BASIS ID optimizes the onboarding process of your company by creating KYC and AML workflows based on prevailing legislation and compliance policies and industry standards. You will know everything you need about your customers’ AML risk level, helping you make crucial decisions and actions. Trusted by financial services providers and fintech institutions, BASIS ID gives you professional advice on your customers and potential clients as well as your financial product.

Eliminate Manual Verification

You don’t have to hire external verification agents and spend precious time and money validating your customers’ information. You can delegate the whole verification process to BASIS ID and free yourself from the trouble of determining whether your customers are a huge risk or not. The software performs a worldwide check on your customers, validating and filtering every account. It also immediately implements mitigation procedures when specific triggers are activated.

Increase Conversions

BASIS ID automatically identifies and follows up on customers who are lacking sufficient evidence in their initial application. This functionality empowers your customers to comply with your requirements, thus, improving your conversion rate. It improves customer retention as well.

Show MoreOverview of BASIS ID Features

- Compliant Worldwide

- Flexible KYC Settings

- Ongoing Screening

- Consent to Data Processing

- Data Storage & Localization

- Breach Notification

- Secure Data Storage

- Data Encryption

- Third-Party Testing

- Vulnerability Control

What Problems Will BASIS ID Solve?

Scenario 1: BASIS ID has a main provision of know your customer (KYC) services for FinTechs, banks, sharing platforms, and payment systems. They provide a service in full compliance with regulations. Furthermore, BASIS ID offers legal support.

Scenario 2: Financial institutions suffer from dynamic regulatory changes such as eKYC guidelines, anti-money laundering laws and data protection regulations country by country. BASIS ID allows full compliance with regulations of the onboarding CDD and AML procedures worldwide.

Scenario 3: For sponsoring regulated institutions (e-money issuers and bin sponsors), BASIS ID can be used to ensure your FinTech is effectively complying with regulations and corporate policies.

Awards & Quality Certificates

BASIS ID Position In Our Categories

Keeping in mind companies have particular business requirements, it is only wise that they abstain from getting an all-encompassing, ideal software product. Nonetheless, it is futile to try to find such an app even among widely used software systems. The sensible step to do is to write down the various main functions which need deliberation such as major features, price plans, skill aptitude of staff, business size, etc. The second step is, you should conduct the product research thoroughly. Browse through these BASIS ID evaluations and scrutinize each of the software products in your shortlist more closely. Such well-rounded product research ascertains you circumvent mismatched apps and buy the one that meets all the function your business requires.

Position of BASIS ID in our main categories:

BASIS ID is one of the top 50 Identity Management Software products

If you are considering BASIS ID it might also be a good idea to investigate other subcategories of Identity Management Software gathered in our base of SaaS software reviews.

Every organization has different wants and needs a software that can be personalized for their size, kind of employees and customers, and the specific industry they are in. For these reasons, no software can proffer perfect functionality out-of-the-box. When you look for a software product, first be sure what you want it for. Read some BASIS ID Identity Management Software reviews and ask yourself do you want basic features or do you want sophisticated functionality? Are there any industry-specific features that you are seeking? Find the answers to these queries to help your search. There are lots of elements that you need to reflect on and these include your budget, particular business wants, your organization size, integration requirements etc. Take your time, try out a few free trials, and finally zero in on the system that offers all that you want to boost your organization competence and productivity.

How Much Does BASIS ID Cost?

BASIS ID Pricing Plans:

$0.60/per verification

What are BASIS ID pricing details?

BASIS ID Pricing Plans:

Free Trial

Starting from

$0.60/per verification

BASIS ID offers the following options:

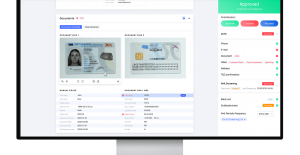

Identity verification

- ID structural validation

- ID digital forgery check

- ID OCR

- ID expiry date tracking

Supported documents

- Passports

- Identity cards

- Driver’s licenses

- Residence permits

- Other

Optical character recognition

- Alphabetical: Latin, Cyrillic, Greek, Armenian, Georgian, Hangu

- Logographic and Syllabic: Hanzi, Kana / Kanji, Hanja

- Abjad: Arabic, Hebrew

- Abugida: North Indic, South Indic, Ethiopic, Thaana, Canadian syllabics

- Automatic OCR autofill / data population

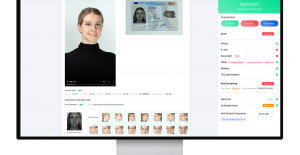

Biometric verification

- Selfie video approach (default)

- Selfie photo approach (optional)

- Biometric facial recognition

- Liveness check

- Spoofing detection

Proof of address

- Verification against ID (Where ID contains address details)

- Verification against Proof of Address document (i.e. Utility bill or Bank statement)

- Existence validation

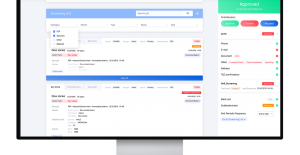

Anti-money laundering Screening

- Ongoing AML screening

- PEP screening

- Sanctions screening

- Media screening

- AML rules

- Custom blacklists

- AML, CTF, OFAC, PEP, HMT, UN, sanction lists, financial and regulatory agencies law enforcement and courts,

business registers, ID/V and search directories, reference sources, adverse media screening across 245

countries and 42842 global, local and proprietary databases - Anti-money laundering (AML)

- Counter-terrorism financing (CTF)

- Office of Foreign Assets Control (OFAC)

- Her Majesty’s Treasury (HMT)

- United Nations (UN)

- Sanction lists

- Politically exposed persons (PEP)

- Adverse media

- Financial and regulatory agencies law enforcement and courts

- Business registers

- AML rule sets

- Configurable risk scoring

- Custom blacklists

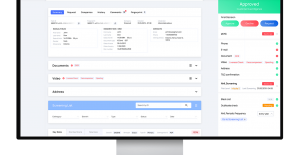

Regulatory compliance

- GDPR compliance

- CCPA compliance

- Financial Action Task Force (FATF)

- 5th Anti-Money Laundering Directive (5AMLD)

- General Data Protection Regulation (GDPR)

- Monetary Authority of Singapore (MAS)

- Swiss Financial Market Supervisory Authority (FINMA)

- Cyprus Securities and Exchange Commission (CySEC)

- Bank Secrecy Act (BSA)

- Financial Conduct Authority (FCA)

STARTING FROM $0.60/per verification

User Satisfaction

We are aware that when you decide to get a Identity Management Software it’s important not only to learn how experts score it in their reviews, but also to discover whether the real clients and companies that purchased these solutions are actually content with the product. That’s why we’ve created our behavior-based Customer Satisfaction Algorithm™ that gathers customer reviews, comments and BASIS ID reviews across a wide array of social media sites. The data is then presented in a simple to understand form indicating how many clients had positive and negative experience with BASIS ID. With that information at hand you will be prepared to make an informed purchasing decision that you won’t regret.

Video

Screenshots

Technical details

Devices Supported

- Web-based

Deployment

- Cloud Hosted

- Open API

Language Support

- English

- Chinese

- German

- Hindi

- Japanese

- Spanish

- French

- Russian

- Italian

- Dutch

- Portugese

- Polish

- Turkish

- Swedish

Pricing Model

- Monthly payment

Customer Types

- Small Business

- Large Enterprises

- Medium Business

What Support Does This Vendor Offer?

- phone

- live support

- training

- tickets

What integrations are available for BASIS ID?

- Application programming interface (API)

- Web software development kit (web-SDK)

- Mutilingual (web- SDK)

- Multi-step verification (via web-SDK)

BASIS ID

is waiting for

your first review.

Write your own review of this product

ADD A REVIEWMore reviews from 0 actual users:

Join a community of 7,369 SaaS experts

Thank you for the time you take to leave a quick review of this software. Our community and review base is constantly developing because of experts like you, who are willing to share their experience and knowledge with others to help them make more informed buying decisions.

- Show the community that you're an actual user.

- We will only show your name and profile image in your review.

- You can still post your review anonymously.

OR

Sign in with company emailSign in with company email