PayEm Review

What is PayEm?

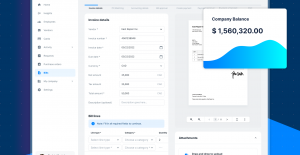

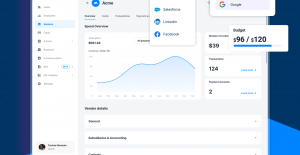

PayEm is a global spend management and procurement system used to handle finance processes, from request to reconciliation. With PayEm, businesses can manage, automate, and connect processes for non-payroll company spending in one platform. It uses automation, smart credit cards, and advanced technologies for payment and reconciliation to streamline payment processes while reducing manual inputs and errors. PayEm is a solution that can save time, increase productivity, reduce costs on multiple tech investments, and provide total visibility and control to finance teams and CFOs on a global level.

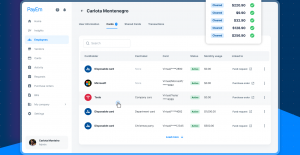

With modern features and an intuitive UI, PayEm makes it easy to create approval flows, simplify vendor payments, and manage subscriptions. Managers and supervisors can approve funding requests in minutes, set rules and limits for budgets, and view real-time spend from right inside the platform. Additionally, the application offers P2P features for your preferred payment method, receipt collection, and reconciliation.

PayEm is also a great fit for global companies. It has a centralized system so finance teams can easily use it to send funds to over 200 territories in 130 different currencies without having to use multiple software.

Meanwhile, employees no longer need to be burdened with complicated and time-consuming reimbursements. PayEm features allow users to reimburse on the go and snap pictures of receipts that approvers can review instantly.

Lastly, the platform integrates seamlessly with ERPs and accounting software using an end-to-end customized request-to-approval workflow. In this way, data is synced, and approved reimbursements are reflected in the company’s books. It also has a deep and seamless NetSuite integration, making it great for companies who already use NetSuite products for their operations.

Show MoreOverview of PayEm Benefits

Automated approval process

PayEm is built to handle everything from request to reconciliation. As such, the platform allows you to create customized, automated approval flows that can make various payment processes more efficient. For instance, employees no longer need to chase approvers for reimbursements or fund requests. They can simply send fund requests which managers can then approve in one click. Employees can also upload invoices quickly using PayEm, so finance teams can promptly check receipts, reconcile expenditures, and approve reimbursements. All the tools and data are in one place, so there is no need to chase receipts, perform time-consuming manual checks, or allocate funds to additional software solutions to complete the task.

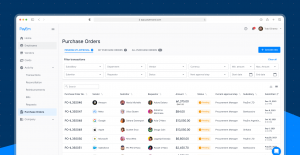

Aside from the functions mentioned above, PayEm offers P2P with the payment method of your choice. It also supports different receipt collection and reconciliation options within the context of your PO.

Technology-driven budgeting and forecasting

Using Excel for budgeting has been the practice for many companies. However, with so much data and values to keep track of, traditional spreadsheets will no longer cut it. PayEm lets CFOs, managers, and admins view spend in real-time to provide more accurate data for budgeting and forecasting.

Moreover, as PayEm supports vendor payments, corporate credit cards, employee expense management, procurement, subsidiary finances, and cross-border payments, you can easily consolidate financial data in one place.

Multinational spend management

Since PayEm’s platform is designed for multinational operations, it can be a perfect solution for global companies that need to schedule and send payments abroad. You can capture invoices, create bills, and pay vendors anywhere in the world in your preferred currency. Files and payments can be auto-categorized and synced with your company’s ERP.

In addition, teams can use PayEm to transfer funds to more than 200 territories. It also supports 130 different currencies, making global transactions seamless.

Deep ERP integration

PayEm uses an advanced end-to-end customized request-to-approval workflow to integrate with popular ERPs and business systems. This feature allows all your data, files, and transactions to be synced and updated automatically. As a result, no more long hours will be wasted on manual data entry. Plus, this helps you avoid errors such as double data entry. As everything is stored and updated in real-time, finance teams can have complete visibility of company spend on department, subsidiary, employee, and vendor levels. Aside from ERPs, PayEm can also integrate with other business applications, including Slack, Quickbooks, and Xero accounting software. You can also connect it with HR management software for easy on and offboarding. To top it all off, the platform is known for its seamless NetSuite integration.

Secured financial data

PayEm not only offers comprehensive functionalities for spend and procurement management, but it also provides ways to keep your financial data safe from prying eyes. For starters, it is equipped with multi-factor authentication and SAML SSO Account Protection. It also uses encryption-in transit using HTTPS and securely stores your data with encryption-at-rest using AES-256 or higher. Also, PayEm is compliant with GDPR and CCPA.

Additionally, PayEm conducts automated penetration testing and annual external auditing to ensure that its pricing is not publicly available. Be sure to contact the vendor for more details regarding their pricing packages.

Show MoreOverview of PayEm Features

- Spend Management

- Expense Reporting

- Physical and Digital Corporate Cards

- Bank Integration

- Digital Receipt Management

- Real-Time Reporting

- Invoice and Request Capture

- Payment Scheduling

- Currency Conversion

- Auto-Categorization

- ERP Synchronization

- AP Automation

- Custom Approval Flow Automation

- Fund Transfers

- Native Mobile App

- Budget Management

- Extensive Security Options

What Problems Will PayEm Solve?

Problem #1: Complicated global transactions

Solution: Transacting with businesses across the globe is easier with PayEm’s centralized system. The platform consolidates all finance processes in one hub, plus it can support fund transfers to over 200 territories. It also supports 130 currencies for your convenience.

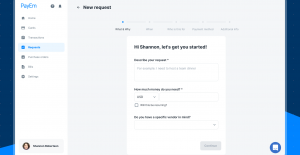

Problem #2: Lengthy procurement process

Solution: PayEm optimizes and accelerates procurement processes through peer-to-peer (P2P) payment. It supports a variety of payment methods, receipt collection options, and reconciliation choices. Plus, it may be fully synced to your ERP. In this way, you can conveniently make payments to vendors and record them in a unified database.

Problem #3: Inconvenient request processes

Another strong suit of PayEm is that it empowers your employees. It allows rank-and-file workers and managers to request and receive funds in real-time using the platform. Plus, as the platform is accessible via desktop or mobile app, they can perform these processes wherever and whenever.

PayEm Position In Our Categories

Because companies have special business-related demands, it is only wise that they abstain from deciding on a one-size-fits-all, ideal software solution. At any rate, it is hard to try to discover such a software product even among sought-after software systems. The rational thing to undertake can be to narrow down the numerous main factors which merit examination including important features, costing, skill aptitude of staff members, organizational size, etc. Then, you must perform your research systematically. Read some PayEm analyses and check out each of the applications in your list in detail. Such comprehensive product research ensures you drop unfit apps and buy the one which offers all the aspects your business requires to achieve growth.

Position of PayEm in our main categories:

PayEm is one of the top 200 Accounting Software products

PayEm is one of the 50 Online Accounting Software products

PayEm is one of the top 50 Procurement Software products

Since each organization has particular business wants, it is prudent for them to desist from looking for a one-size-fits-all perfect software application. Needless to say, it would be pointless to try to find such a platform even among widely used software platforms. The clever thing to do would be to list the various vital elements that require consideration such as required features, finances, skill levels of workers, company size etc. Then, you should do your research thoroughly. Read some PayEm Accounting Software reviews and check out each of the other systems in your shortlist in detail. Such exhaustive homework can ensure you weed out ill-fitting applications and choose the app that provides all the features you require for business success.

How Much Does PayEm Cost?

PayEm Pricing Plans:

By Quote

What are PayEm pricing details?

PayEm Pricing Plans:

Free Trial

Custom

By Quote

PayEm currently does not provide its pricing information publicly. Be sure to get in touch with the vendor for more details about their packages.

User Satisfaction

We realize that when you choose to buy a Accounting Software it’s important not only to learn how experts score it in their reviews, but also to check whether the actual users and enterprises that bought it are actually happy with the service. Because of that need we’ve devised our behavior-based Customer Satisfaction Algorithm™ that collects customer reviews, comments and PayEm reviews across a wide range of social media sites. The data is then presented in a simple to digest form revealing how many clients had positive and negative experience with PayEm. With that information available you will be ready to make an informed buying decision that you won’t regret.

Video

Screenshots

Technical details

Devices Supported

- Windows

- Android

- iPhone/iPad

- Mac

- Web-based

Deployment

- Cloud Hosted

Language Support

- English

Pricing Model

- Quote-based

Customer Types

- Small Business

- Medium Business

What Support Does This Vendor Offer?

- phone

- live support

- training

- tickets

What integrations are available for PayEm?

PayEm has seamless NetSuite & Quickbooks Online integrations, allowing users to sync it to their NetSuite & Quickbooks accounts.

PayEm

is waiting for

your first review.

Write your own review of this product

ADD A REVIEWMore reviews from 0 actual users:

Join a community of 7,369 SaaS experts

Thank you for the time you take to leave a quick review of this software. Our community and review base is constantly developing because of experts like you, who are willing to share their experience and knowledge with others to help them make more informed buying decisions.

- Show the community that you're an actual user.

- We will only show your name and profile image in your review.

- You can still post your review anonymously.

OR

Sign in with company emailSign in with company email