Plooto Review

What is Plooto?

Plooto is an online payment management system that integrates with leading accounting software like Quickbooks, Quickbooks Online, and Xero to provide end-to-end AP & AR automation. It is ideal for accounting professionals, accounting and bookkeeping firms, and small and medium businesses who are looking for a simple, cost-effective solution to make their accounts receivable and payable process more efficient. Freelancers and professionals can also benefit from the software as it allows them to send invoices and get paid faster with bank-grade security.

Perhaps one of the most significant differences between Plooto and other online payment systems is that payments can be processed even if the client or vendor doesn’t have a Plooto account. All you need is their email address and funds are directly and securely transferred to their bank accounts, which also helps you avoid expensive wire transfer fees and unnecessary charges. Invoices you send and payments you receive are also automatically reconciled and marked as paid in your accounting software, making the entire transaction simpler, faster, and cheaper.

If you want to get rid of tedious and repetitive manual data entry work, Plootoo has powerful automation and smart workflow features that can save your business countless hours and allow your staff to focus more of their time on high-value tasks. For example, you can connect your company’s bank account on Plooto and easily set up plans for recurring payments and pre-authorized debit or PAD payments. You can customize approval tiers and receive real-time notifications on transactions and electronic audit trails so you can easily keep track of any changes made on payments. Since everything is done electronically, you can also avoid checks and save time on going to the bank to deposit payments.

Plooto allows you to send payments anywhere in the US, Canada, and over 30 other countries with competitive exchange rates. You can send in major currencies such as the US dollar, Canadian dollar, Euro, Hong Kong dollar, Chinese Yuan, and UK pound sterling, just to name a few.

Plooto only operates in Canada and the USA.

You can start using Plooto through a one-month free trial. Succeeding monthly subscriptions are priced at $32 and $59, which already gives you access to full features, such as unlimited bank account connections, unlimited users per business, unlimited approvers, and unlimited customers and vendors.

Show MoreOverview of Plooto Benefits

Simplify Your Workflow

Simplify your workflow and streamline your accounts payable and receivable processes by having all your company decision-makers on one single platform. Make approvals on-the-go with your mobile phone and enable teams to work remotely.

Eliminate tedious and repetitive manual data entry work with automation and smart workflow features. By integrating your accounting software (Xero and QuickBooks) all details about your vendors, customers, bills, and invoices will seamlessly sync directly into Plooto.

Customize Approval Tiers

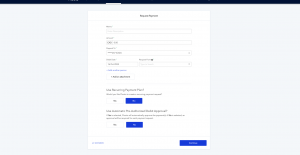

Plooto allows you to customize your approval process so that payments can be reviewed and approved before any funds are processed. You can select who can create, edit, and authorize transactions with just a few clicks.

Automate Your Accounts Payable and Receivable Processes

Plooto can adapt to your specific needs no matter how your business runs. Whether you’re collecting a one-time payment from a new customer, or recurring payments from a trusted partner, Plooto provides you a wide variety of payment options you need, all in one platform. You can also postdate payments for suppliers and customers you interact with on a regular basis.

With Plooto, payments can be processed even if your clients or vendors don’t have a Plooto account, all you need is their email address. If you do not have their banking information for a direct deposit, you can simply provide a contact name, email, and company name. When payment is made, your contact receives an email from Plooto to provide their banking information and accept the funds.

Control and Have Full Visibility into Your Cash Flow

Have certainty over your cash flow. See every detail of your payment’s status – when payment was made, where it is, when it will arrive in your account. You no longer are required to backtrack and follow-up with overdue invoices. Plooto automatically updates your records for completed transactions and sends real-time updates on the status of bills or invoices owed to your business.

Show MoreOverview of Plooto Features

- Digital Approvals (Desktop & Mobile)

- Automated Workflows

- Electronic Payments (Accounts Payable & Accounts Receivable)

- International Payments (Multiple Currencies Available)

- Check Payments

- CRA Remittance Payments (Canada Only)

- Xero Integration (Two-way Sync, Instant Reconciliation)

- QuickBooks Integration (Two-Way Sync, Instant Reconciliation)

- Fraud Detection

- Audit Trails and Record-Keeping

What Problems Will Plooto Solve?

Scenario 1: Cumbersome payment processing

Jane’s company works with an external bookkeeper, Dave. Dave logs all the bills in the accounting software, and the bills are automatically imported into Plooto. Jane logs into Plooto, makes sure everything looks good, and approves the payments. Plooto automatically makes electronic payments to the vendors and reconciles the accounting records. Both Jane and Dave save hours of time without compromising control.

Scenario 2: Payment bottlenecks

Each bill needs two signatures before the bill can be paid. Paul inputs the bills into his accounting software, which imports them automatically into Plooto. Board members are notified by email, and log into Plooto and approve the payment online—even on their phone and on the road. Once both approvals are received, Plooto makes the electronic payment and reconciles the accounting records. Plooto also keeps the audit trail, indicating who approved what. The organization avoids payment bottlenecks while controlling their spending, and Paul doesn’t have to run around getting signatures on checks.

Scenario 3: Complex approval process

Carla is busy running her business and doesn’t want to approve every nickel and dime. She tells her accountant, Jean: “Go ahead and make payments under $100. I’ll look at those at the month-end. But for payments between $100 and $500, get approval from my office manager. Anything over $500, send it to me.” Jean sets up approval tiers in Plooto, and when the bills are logged, the right people get notified by email. They log in and approve payments, which are made automatically. The books are instantly reconciled, and Plooto keeps an audit trail for future reference. Carla is able to delegate work without giving up control, and Jean is able to spend less time on AP and more on providing high-quality advisory services.

Awards & Quality Certificates

Plooto Position In Our Categories

Since companies have distinctive business needs, it is only wise they steer clear of deciding on an all-in-one, ”best” solution. Still, it is futile to try to find such an app even among sought-after software systems. The best step to do would be to narrow down the various major factors that necessitate examination such as critical features, plans, technical skill levels of the employees, business size, etc. Next, you should follow through the research fully. Go over some of these Plooto evaluations and check out each of the software programs in your list more closely. Such comprehensive research makes sure you avoid unfit applications and select the system which has all the benefits your business requires.

Position of Plooto in our main categories:

Plooto is one of the top 100 Accounting Software products

Since each enterprise has unique business requirements, it is sensible for them to refrain from looking for a one-size-fits-all ideal software system. Needless to say, it would be pointless to try to find such an app even among market-leading software applications. The smart thing to do would be to jot down the various important factors that need consideration such as key features, budget, skill levels of staff members, company size etc. Then, you should do your groundwork thoroughly. Read some Plooto Accounts Payable Software reviews and look into each of the other systems in your shortlist in detail. Such exhaustive research can ensure you reject ill-fitting systems and choose the app that provides all the aspects you need for business success.

How Much Does Plooto Cost?

Plooto Pricing Plans:

C$9

C$32

Contact vendor

What are Plooto pricing details?

Plooto Pricing Plans:

Free Trial

Go

C$9

Grow

C$32

Pro

Contact vendor

Plooto offers various SMB and enterprise pricing options and a 30-day free trial of any plan. Accountants and bookkeepers can get free or discounted plans by contacting the vendor.

For Businesses

Grow – C$32/month

- Automatic two-way sync with Xero and Quickbooks

- Streamline invoice processing with Plooto Capture (OCR)

- Set custom approval workflows with unlimited approvers

- Work with unlimited accountant users

- Conduct unlimited domestic transactions per month ($0.5 each)

- Send international payments with competitive exchange rates

- Accept payments with Pre-Authorized Debits (PAD) and credit card

Pro – By quote

- Everything in Grow +

- Automatic two-way sync with Netsuite

- Implement dual controls on user actions

- Manage user access with single sign-on (SSO)

- Access priority customer support

For Accounting Firms

Go – C$9/month

- Automatic two-way sync with Xero and Quickbooks

- Streamline invoice processing with Plooto Capture (OCR)

- Set basic approval workflows with 1 approver

- Work with 1 accountant user

- Conduct 5 domestic transactions per month ($1 each)

- Send international payments with competitive exchange rates

- Accept payments with Pre-Authorized Debits (PAD) and credit card

Grow – C$32/month

- Everything in Go +

- Set custom approval workflows with unlimited approvers

- Work with unlimited accountant users

- Conduct unlimited domestic transactions per month (C$0.5 each)

Pro – By quote

- Everything in Grow +

- Automatic two-way sync with Netsuite

- Implement dual controls on user actions

- Manage user access with single sign-on (SSO)

- Access priority customer support

User Satisfaction

We realize that when you decide to get a Accounts Payable Software it’s vital not only to find out how experts score it in their reviews, but also to find out whether the real clients and enterprises that purchased this software are indeed happy with the product. That’s why we’ve designer our behavior-based Customer Satisfaction Algorithm™ that aggregates customer reviews, comments and Plooto reviews across a vast range of social media sites. The data is then displayed in a simple to understand way revealing how many users had positive and negative experience with Plooto. With that information available you will be prepared to make an informed purchasing choice that you won’t regret.

Video

Screenshots

Technical details

Devices Supported

- Windows

- Linux

- Android

- iPhone/iPad

- Mac

- Web-based

- Windows Mobile

Deployment

- Cloud Hosted

Language Support

- English

Pricing Model

- Monthly payment

Customer Types

- Small Business

- Medium Business

- Freelancers

What Support Does This Vendor Offer?

- phone

- live support

- training

- tickets

What integrations are available for Plooto?

-

NetSuite

-

QuickBooks

-

QuickBooks Online

-

Xero

Plooto

is waiting for

your first review.

Write your own review of this product

ADD A REVIEWMore reviews from 0 actual users:

Join a community of 7,369 SaaS experts

Thank you for the time you take to leave a quick review of this software. Our community and review base is constantly developing because of experts like you, who are willing to share their experience and knowledge with others to help them make more informed buying decisions.

- Show the community that you're an actual user.

- We will only show your name and profile image in your review.

- You can still post your review anonymously.

OR

Sign in with company emailSign in with company email